Dear readers,

Today, I want to discuss the impact of rising interest rates and bond sell-offs on the economy. It's an important topic that affects all of us, whether we realize it or not.

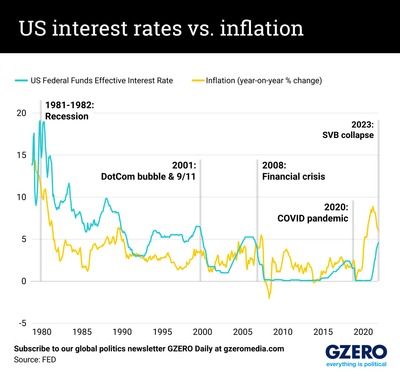

First, let's talk about the Federal Reserve's quantitative tightening. This policy is one of the factors pushing long-term interest rates higher. If the Fed wants to stop long-term interest rates from skyrocketing, they may need to consider dialing back quantitative tightening.

Rising interest rates have unintended consequences, especially in the world of mortgage rates. Two buyers with similar financial profiles and making similar purchases can end up with monthly payments that differ by hundreds of dollars. The average 30-year fixed mortgage rate hit a fresh 23-year high this week, and the range of mortgage rates has more than doubled since the Fed started raising rates.

Another consequence of higher yields is that deficits finally matter. The U.S. has long been the lender of last resort to the world, but now the Treasury itself is a source of risk. This shift in dynamics has significant implications for the global economy.

Markets were volatile on Thursday, with the S&P 500 declining slightly and the Nasdaq Composite and Dow industrials remaining flat. The benchmark 10-year Treasury yield settled at 4.715%, below Wednesday's finish. Investor focus is now shifting to Friday's key jobs report, which will provide further insights into the state of the economy.

Now, let's turn our attention to the impact of rising gas prices. While the OPEC oil cartel plays a role in determining what U.S. drivers pay at the pump, there are other factors closer to home that are having a surprising impact. Cigarette sales and convenience store wages are affecting profitability at gas stations, contributing to higher prices for consumers.

In other news, The Wall Street Journal's Evan Gershkovich is being wrongfully detained in Russia after being arrested on a reporting trip. The Journal and the U.S. government vehemently deny the spying charges. You can follow the latest coverage, sign up for email alerts, and support Evan through social media.

Lastly, the bond sell-off is forcing the Federal Reserve to rethink its strategy of shedding assets. Long-term interest rates have risen significantly, creating challenges for the economy as it faces new hurdles. These hurdles include ongoing strikes against Detroit automakers, the resumption of student-debt payments, and the possibility of a government shutdown.

That's all for now, my friends. Stay informed, stay curious, and remember to consider the impact of rising interest rates and bond sell-offs on your own financial well-being.

Until next time,

Daniel Silva

Comments

Post a Comment