Hey there, readers! Today, I want to talk about something that has been making waves in the world of finance and technology: the rise of artificial intelligence (AI) and the trillion-dollar companies that have emerged as a result.

It wasn't too long ago when a trillion dollars seemed like an astronomical amount of money. Apple was the first to cross that market value threshold, followed by Nvidia, which recently punched through the $2 trillion barrier. But here's the thing, Nvidia is only the third most valuable stock on the planet!

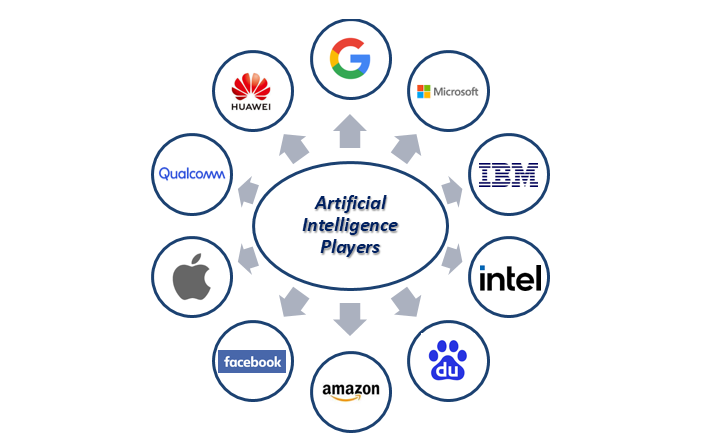

The excitement over AI has been a game-changer, adding trillions of dollars of market value to the top six companies in the S&P 500. These companies, known as the Splendid Six, collectively make up more than a fourth of the benchmark index. That's more than all the large banks, insurers, industrial companies, and consumer staples companies in America combined!

It's mind-boggling to think that Nvidia alone is worth about 20% more than all energy companies combined. Remember when Exxon Mobil was America's most valuable company? Times have certainly changed.

But will AI technology live up to the hype? Will these handful of American companies continue to dominate and reap the lion's share of future profits? Only time will tell. After all, the internet was also a game-changer, but we don't hear much about Cisco Systems, America Online, and Lucent anymore.

If you're interested in diving deeper into the economic history and understanding the potential risks and rewards of AI, I highly recommend reading a fascinating essay by Jinjoo Lee and Carol Ryan. It provides valuable insights into why knee-jerk reactions to calamities often lead to selling rather than buying.

Speaking of calamities, let's not forget the global tensions and conflicts that continue to brew. With a land war still raging in Europe and the threat of nuclear anti-satellite weapons, one might expect stock prices to be affected. However, major U.S. stock indices remain resilient, with mixed performances after hitting record highs.

Now, let's shift gears and talk about something that affects all of us: car insurance. Have you noticed how insanely expensive it has become? This trend isn't limited to the U.S.; large insurers in Europe have also reported surges in motor insurance premiums. It's a global phenomenon that's hitting our wallets hard.

But enough about insurance woes. Let's end on a positive note. Despite the challenges and uncertainties, the stock market continues to offer opportunities. Stay tuned for Berkshire Hathaway's annual letter and upcoming quarterly results from companies like Workday, Baidu, Lowe's, Salesforce, and Anheuser-Busch InBev.

That's all for now, folks! Remember, the world is ever-changing, and we're here to navigate it together.

Comments

Post a Comment