Hello readers, today we're diving into the world of stocks and market events. JPMorgan Chase, Citigroup, and Wells Fargo are set to report results early Friday, and investors are on the lookout for signs of weakness in the banking system, real-estate losses, and cracks in consumers' finances. Nvidia shares are steady premarket after skidding Thursday when slowing inflation prompted investors to pile out of high-flying tech stocks and into market laggards. 🚨 Follow our live coverage throughout the day for bank results and other market news.

In today's featured article, Heard on the Street's Aaron Back argues that the risks of waiting too long to cut interest rates outweigh those of going soon. The risks are real, and it's time for the Federal Reserve to end the waiting game. The article delves into the current market conditions and the potential impact of delaying rate cuts.

Stocks to Watch:

- SoftBank: The tech conglomerate's shares fell more than 4% in Tokyo, echoing a decline in Arm's shares in the U.S. Thursday. SoftBank owns a 90% stake in Arm and has just bought Graphcore, another U.K. chip company.

- Tesla: The EV maker's shares dropped in premarket trading, on track to extend steep losses from Thursday, when they sank over 8%. The move came after Bloomberg reported the company was postponing plans to unveil its Robotaxi in August.

- Ericsson: The telecom-equipment company said its sales should get a boost in the second half of the year as deliveries pick up in North America. Ericsson's Swedish stock jumped more than 7%.

- Microsoft: Republican lawmakers are seeking a probe into the company's $1.5 billion investment in Abu Dhabi-based AI firm G42, citing concerns about possible ties with China.

- JPMorgan, Citi, Wells Fargo, and Bank of New York Mellon report results before the market opens.

Enjoying this newsletter? Get more from WSJ and support our journalism by subscribing today with this special offer.

Time for the Fed to End the Waiting Game by Aaron Back

Why wait until September? That is the question hanging over markets after Thursday’s surprisingly weak inflation reading. There doesn’t seem to be much reason for the Federal Reserve to put off cutting rates any longer, and waiting too long carries risks of its own. The Fed’s publicly stated criteria for a rate cut, that it can be confident inflation is moving down toward its 2% target, appears to have been met. Stripping out food and energy, core inflation as measured by the consumer-price index has either slowed or stayed the same for 16 straight months. It is unclear what catalysts there could be on the horizon to drive a resurgence in inflation. Meanwhile, warnings from consumer-facing companies that American shoppers are tapped out keep coming, and even seem to be rising in intensity. Keep reading.

Share this email with a friend. Forwarded this email by a friend? Sign Up Here.

The Wall Street Journal’s Evan Gershkovich is being wrongfully detained in Russia after he was arrested while on a reporting trip and accused of spying—a charge the Journal and the U.S. government vehemently deny. Follow the latest coverage, sign up for an email alert, and learn how you can use social media to support Evan.

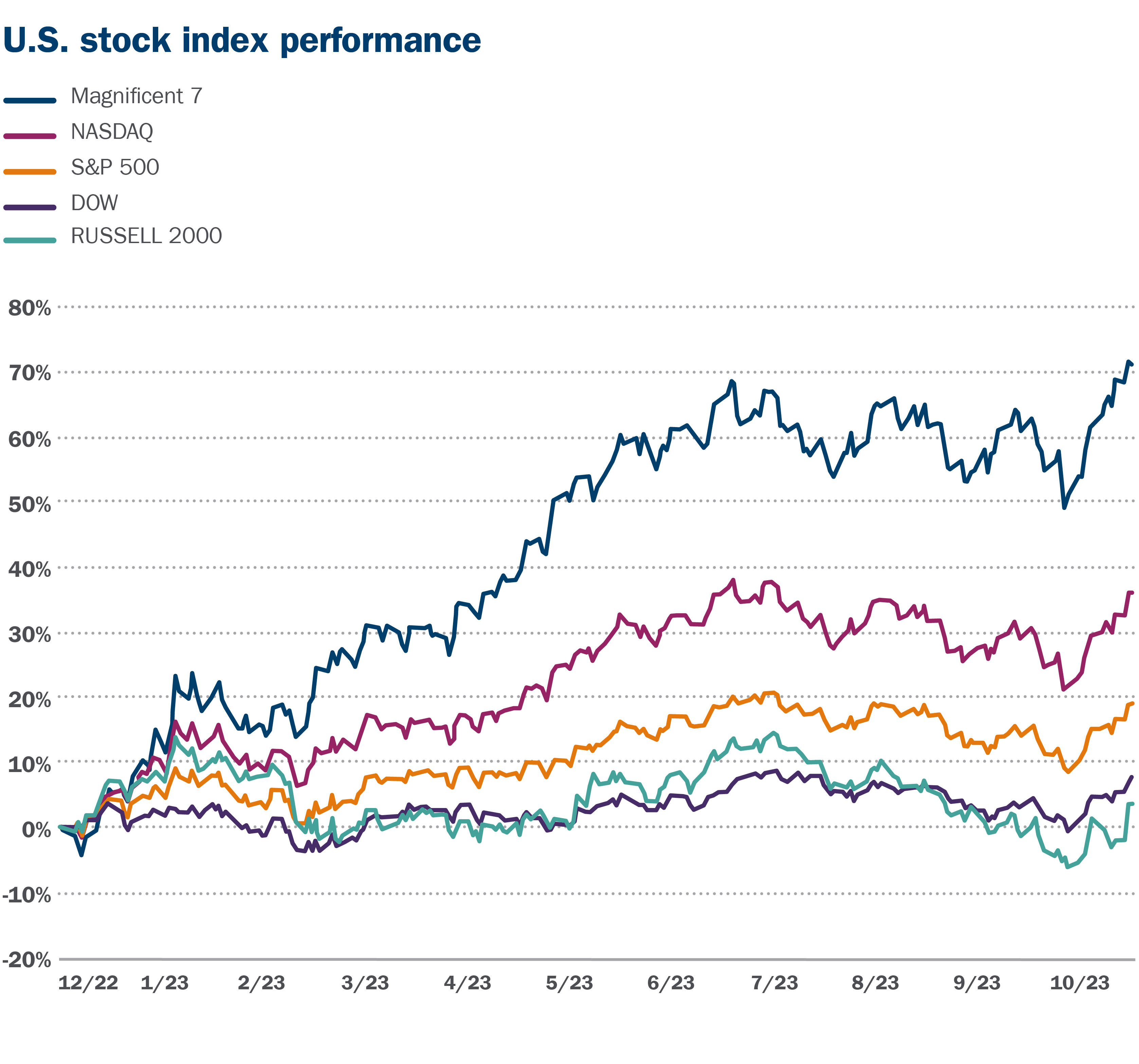

Charting the Markets

Artificial intelligence is about to be the undisputed star of yet another earnings season. Looking further ahead, other performers will need to step up, Jon Sindreu writes for Heard on the Street.

Natural-gas prices are melting down in the summer heat, an unusual trajectory at the height of air-conditioning season. There's about 19% more gas in domestic storage facilities than the five-year average, the Energy Information Administration said Thursday.

Economists surveyed by The Wall Street Journal put the probability of a recession in the next year at 28%. Most said inflation, interest rates, and deficits would likely be higher under a second Trump administration than if President Biden stays in the White House.

Must Reads

The CPI report showed prices cooled broadly in the second quarter. After the inflation report was released, investors dialed up bets that the Fed would cut rates twice this year. The likelihood of a third cut climbed, implying the central bank could lower rates at its last three meetings of the year, in September, November, and December. Small-business owners have lots of aggravations. The U.S. Supreme Court just added to their burden. Just about everyone in Houston is wondering why—in the country’s fourth-largest city, which calls itself the energy capital of the world—widespread power outages keep happening. More: Delta’s Sagging Profit Signals Trouble for Airlines This Summer, PepsiCo, After Years of Price Hikes, Sounds an Alarm on Consumer Spending, China’s Economy Is Flagging. A Five-Year Plan Seeks to Change That.

This Day in Markets 📈 On this day in 1773, Jonathan's Coffee House in London, where brokers had met for decades to smoke, drink and trade, was renamed the Stock Exchange.

Beyond the Newsroom Buy Side from WSJ: Amazon's Prime Day is July 16-17: Here's How to Shop

Comments

Post a Comment