Dear readers,

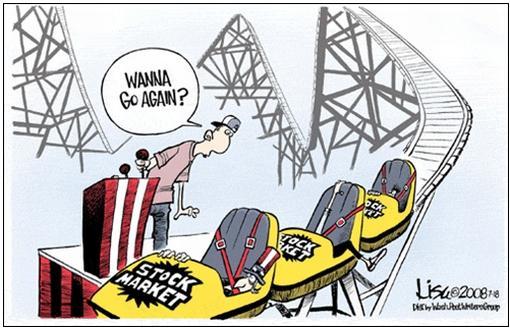

What a roller coaster ride it has been on Wall Street! The recent market plunge drew comparisons with Black Monday nearly 37 years ago, causing trillions of dollars in losses and real anxiety. However, the rebound has been equally impressive, with Japanese stocks rallying by more than 10% on Tuesday.

Volatility traders often stress that it takes time to clear bad trades from the system, and history shows that a volatility spike can lead to a higher trading range for the VIX, as well as potential aftershocks. Even amid this market turbulence, corporate news has been making waves. Google-parent Alphabet and Apple faced setbacks, affecting their shares on an otherwise positive day for technology companies.

Despite the chaos, the Dow Jones Industrial Average closed 294 points higher, and the Nasdaq Composite jumped 1.03%. Bond yields also rose across the board, marking the largest gain since July 1 for the benchmark 10-year U.S. Treasury note.

This week’s stock-market roller coaster appears to be driven by a reversal in speculative trades, rather than the popping of a bubble or an omen of economic disaster. But that doesn’t mean we are in the clear. The lightning-fast rebound mirrors the pattern observed Monday in the Cboe Volatility Index, or VIX—a measure of the expected volatility of the S&P 500, known as Wall Street’s “fear gauge.”

Stay tuned for more updates and insights from the world of finance and markets.

Best regards,

Daniel Silva

Comments

Post a Comment