Stocks and Market Movements: Kroger's Surge and Oil Price Cooldown

Hello, dear readers! Today, we delve into the nuanced world of stock markets and recent economic events that are shaping the landscape. As we close the week, let's take a closer look at some key movements and what they might mean for investors.

Stock Performance Overview

This week, the stock market witnessed a relatively stable performance with minor fluctuations. The S&P 500 dipped by 0.2% on Friday, while the Dow Jones Industrial Average managed a modest increase of 35 points. The Nasdaq Composite, on the other hand, experienced a 0.5% decline. Such movements might seem trivial, but they reflect underlying market sentiments and economic conditions.

Kroger's Impressive Performance

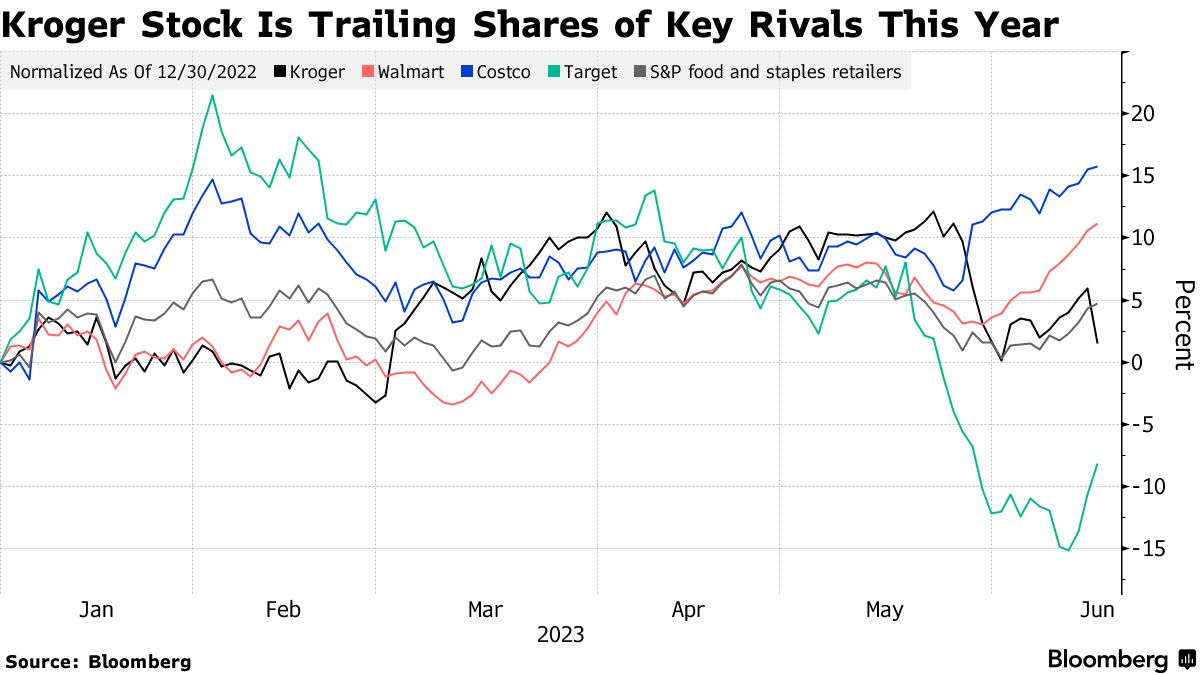

Among the S&P 500 constituents, Kroger stood out with a remarkable performance. The supermarket chain's shares surged nearly 10% following its latest earnings call. This uptick is attributed to economic uncertainties prompting more consumers to choose grocery stores over dining out, given the rising restaurant prices. Kroger's strategic positioning and adaptability appear to be paying off, making it a stock worth watching.

Oil Prices and Geopolitical Dynamics

Oil prices have shown signs of cooling off recently. Comments from President Trump have contributed to easing concerns about potential U.S. military intervention in Iran, which had previously fueled fears and driven oil prices up. The geopolitical landscape remains a critical factor in oil market fluctuations, and investors should stay informed about ongoing developments.

Federal Reserve's Stance on Interest Rates

In monetary policy news, Federal Reserve Governor Christopher Waller advocated for a cautious approach regarding interest rate adjustments. He emphasized the importance of looking beyond temporary price hikes caused by tariffs. The ten-year Treasury yields remain below 4.4%, suggesting a stable interest rate environment for now. Investors should keep an eye on the Fed's moves as they can significantly impact market dynamics.

The Dollar's Resurgence

The U.S. dollar has shown renewed strength, with the WSJ dollar index rising by 0.7% this week. In times of global uncertainty, the dollar often acts as a safe haven, attracting investors seeking stability. This trend is likely to continue as geopolitical tensions and economic indicators evolve.

Upcoming Economic Indicators

Looking ahead, several key economic indicators are set to be released next week. These include data on home sales, the S&P Case-Shiller home price index, and the consumer confidence index. Additionally, the revised GDP growth report and the Federal Reserve's preferred inflation measure, the Personal Consumption Expenditure index, will be closely monitored. Fed Chair Jerome Powell's upcoming testimony in Congress is also anticipated to provide insights into the Fed's future policy direction.

Corporate Earnings Reports

Next week, several major corporations are scheduled to release their earnings reports. Among them are KB Home, FedEx, General Mills, and Nike. These reports will offer valuable insights into the performance of different sectors and could influence market sentiment.

As we wrap up this overview, it's essential to recognize the interconnectedness of various economic factors and their impact on stock markets. Staying informed and adaptable is key to navigating the complexities of investing in today's dynamic environment.

Feel free to share your thoughts and insights in the comments below. Until next time, happy investing!

Comments

Post a Comment