Market Insights: Kroger's Rise, Oil Price Dynamics, and The Row's Luxury Challenge

Hello, dear readers! Today, we delve into some intriguing developments in the stock market, focusing on Kroger's impressive performance, the shifting dynamics of oil prices, and an unexpected challenger in the luxury handbag market.

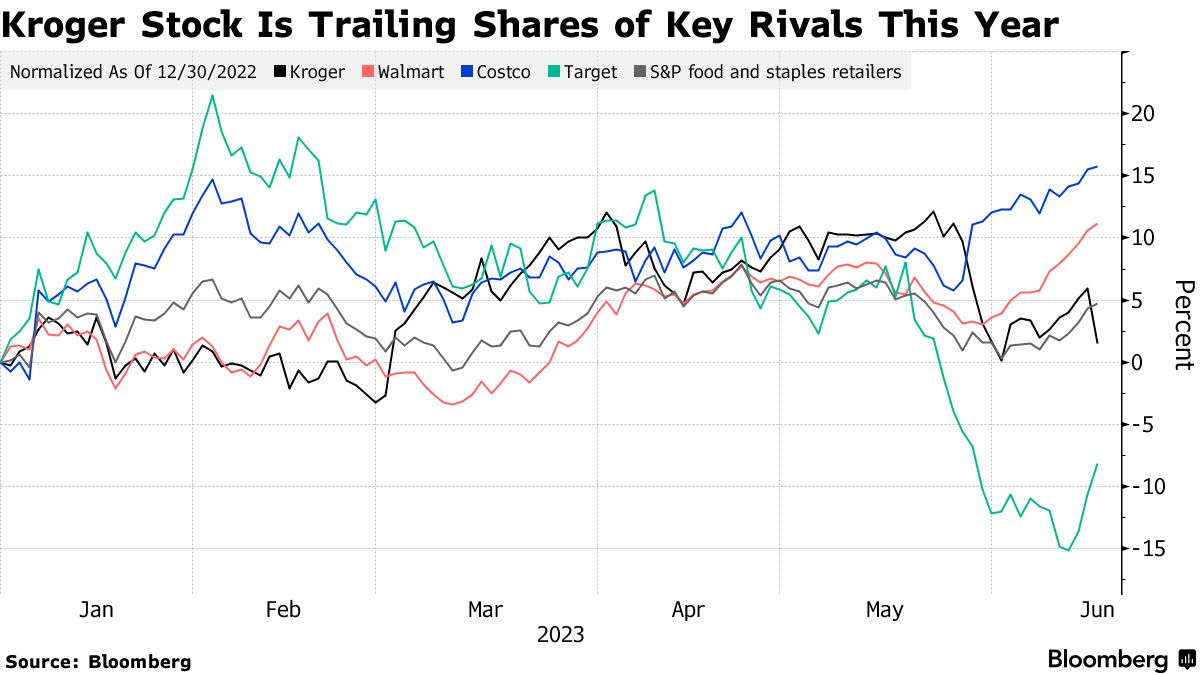

Kroger's Surge Amid Economic Uncertainty

This week, Kroger stood out as a beacon of resilience in the S&P 500, with shares climbing nearly 10%. The supermarket chain attributed this surge to the economic jitters that are prompting more consumers to shop at its stores instead of dining out, as restaurant prices continue to rise. This trend highlights a shift in consumer behavior, where practicality is taking precedence over luxury dining experiences.

Oil Prices and Geopolitical Tensions

In the realm of commodities, oil prices have cooled, thanks to reassuring comments from President Trump, which eased fears of imminent U.S. military intervention in Iran. This development has provided a sense of relief to the markets, which were previously bracing for potential disruptions in oil supply.

The Federal Reserve's Stance on Rate Cuts

Another significant development was the statement from Fed Governor Christopher Waller, who suggested that the central bank should "look through" one-time price increases resulting from tariffs. This indicates a potential shift towards rate cuts, aiming to stabilize the economy amidst ongoing global trade tensions.

The Dollar's Resurgence

The dollar has been making a comeback, with the WSJ dollar index rising by 0.7% this week. The greenback is once again acting as a safe haven amid global conflict, providing a stable option for investors in uncertain times.

The Row: A New Challenger in Luxury

In the luxury market, The Row, a relatively small American brand, is making waves by becoming a more convincing challenger to the iconic Hermès Birkin bag. The company's Margaux handbag has joined the ranks of luxury products that command higher prices secondhand than new, a distinction shared with the Birkin and high-end watches from Rolex and Patek Philippe.

Chanel has also been feeling the pressure, with recent results showing a 4% drop in sales for 2024 and a significant decline in operating profit. In contrast, Hermès continues to thrive, with a 15% increase in sales last year.

What's on the Horizon?

Looking ahead, next week promises to be eventful with data releases on home sales, the S&P Case-Shiller home price index, and the consumer confidence index. Additionally, the revised GDP growth report and the Personal Consumption Expenditure index, the Fed's favored inflation measure, will be closely watched by investors.

Furthermore, Fed Chair Jerome Powell's testimony in Congress will be a key event, providing insights into the central bank's future policy direction.

Earnings reports from major companies like KB Home, FedEx, General Mills, and Nike are also on the docket, which could provide further clues about the health of the economy and consumer spending patterns.

As always, stay tuned for more updates and insights. Until next time, keep an eye on the markets and make informed decisions.

Comments

Post a Comment