Kroger's Surge and the Market's Subtle Shifts: A Week in Review

Hello readers! This week on Wall Street, the markets wrapped up with a mix of subtle changes and standout performances. Let’s explore what happened and what it means for investors like you.

The Market's Mixed Bag

This past week, the S&P 500 experienced a slight dip of 0.2%, while the Dow Jones Industrial Average managed to add a modest 35 points. The Nasdaq Composite, on the other hand, saw a small decline of 0.5%. These movements might seem minor, but they reflect the underlying dynamics affecting investor sentiment.

Kroger's Impressive Performance

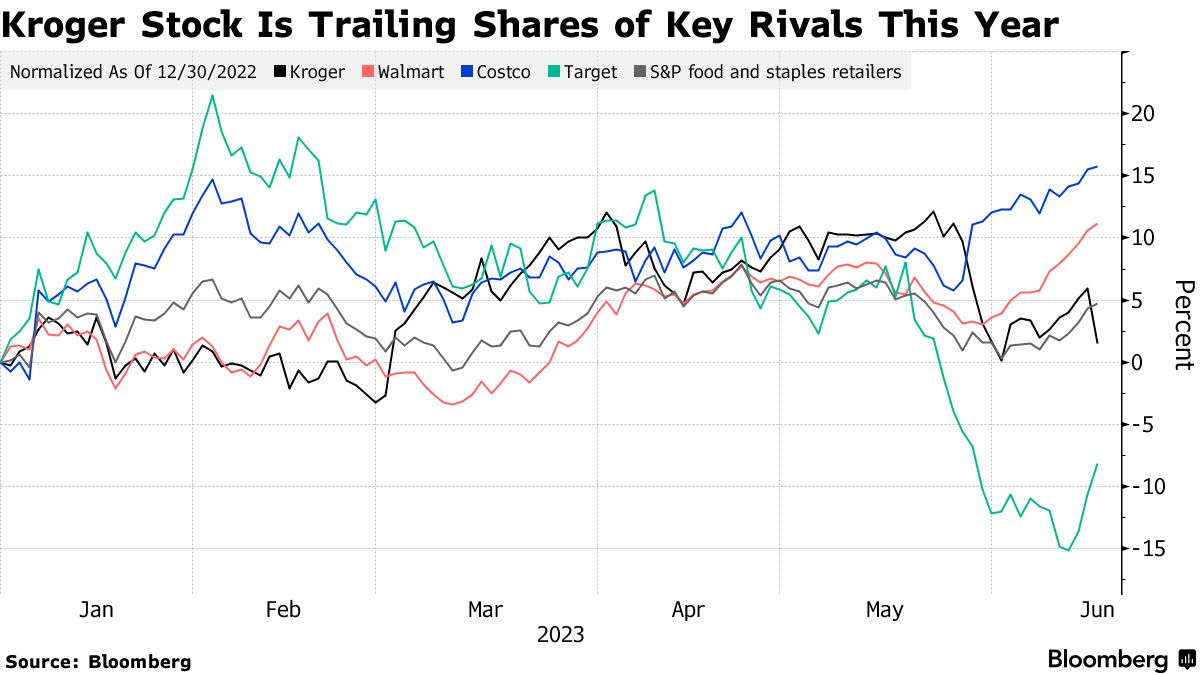

One of the highlights was Kroger, whose shares led the S&P 500 with an impressive rise of nearly 10%. This surge was driven by the supermarket chain's earnings call, where they noted an increase in shoppers due to rising restaurant prices. It appears that economic uncertainties are prompting more consumers to opt for grocery shopping over dining out.

Oil Prices and Global Tensions

Oil prices cooled off this week, thanks in part to comments from President Trump which helped alleviate fears of imminent military intervention in Iran. This development provided some relief to the markets, as oil prices often react sharply to geopolitical tensions.

The Federal Reserve's Influence

Another crucial factor was the Federal Reserve's stance on interest rates. Fed Governor Christopher Waller suggested that the central bank should “look through” one-time price increases caused by tariffs. This hints at the possibility of rate cuts, which could have significant implications for the markets.

The Dollar's Rebound

The dollar made a comeback, with the WSJ dollar index rising by 0.7% this week. Amid global conflicts, the greenback is once again acting as a safe haven for investors, showcasing its resilience in uncertain times.

Luxury Brands in the Spotlight

In the world of luxury goods, Chanel is facing tough competition from Hermès and a rising American brand, The Row. While Chanel reported a decline in sales and operating profit, Hermès enjoyed growth. The Row is also making waves, with its Margaux handbag gaining popularity and value in the secondhand market.

Looking Ahead

As we look to the coming week, there are several key events to watch. Data on home sales, the S&P Case-Shiller home price index, and the consumer confidence index will provide insights into the housing market. Additionally, the revised GDP growth report and the Personal Consumption Expenditure index will offer clues about the overall economic health.

Fed Chair Jerome Powell is set to testify in Congress, which could influence market expectations regarding monetary policy. Earnings reports from companies like KB Home, FedEx, General Mills, and Nike will also be closely monitored.

In conclusion, while the markets ended the week with minor changes, there are significant developments and upcoming events that could shape the financial landscape. Stay informed and be prepared to adapt your strategies as needed.

Comments

Post a Comment